There is a risk that the value of the stocks which you bought will go down. And if you're forced to sell your stocks during such times (because you really need cash), then you will experience an actual loss.

Archives for October 2014

When Stock Prices Go Down, Rejoice!

Long-term stock market investors like us rejoice when the stock prices go down, because that means good stocks become more affordable. This allows us to buy more of these good stocks, so that when their stock prices go up in the future, we'll be able to sell more and earn more.

Of course, there's something we need to keep in mind...

Hi! I'm Manny Viloria, and I enjoy helping others learn how to invest (long-term) in the Philippine stock market.

One of the important things we need to keep in mind is this: The stock market does NOT guarantee that you will earn.

But when we do earn, it's so much higher than what we can earn by simply placing our money in the bank.

And what helps boost our confidence is finding ways to generate EXTRA cash that we can invest in the stock market. That way, our salary or Active Income will remain untouched.

Anyway, I'm happy to share with you that stock prices went down recently. But we're not tearing our hair out and shouting "Oh no!"

Instead, we're exclaiming "YEHEY!" because we now have more choices as far as which stocks to buy is concerned.

Last week, the Truly Rich Club members were shown four stocks worth buying. Today, we're now seeing 6 stocks.

That's good because we have additional options on where to put our money.

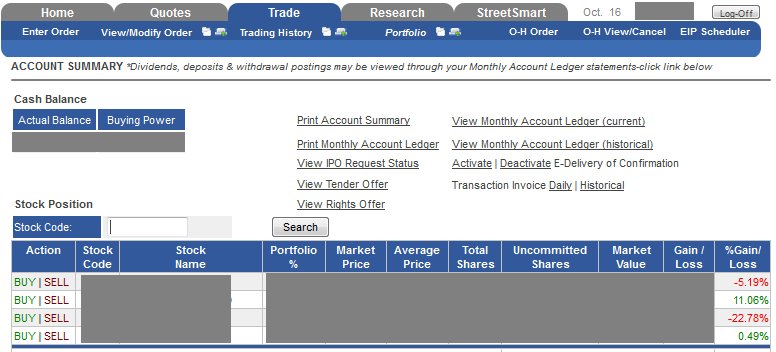

Look at this COL Financial screenshot:

In the above example, we see that I've invested in 4 stocks. Let's just call them Stocks A, B, C, and D.

Do you see the red negative 22.78 percent? That stock's price is below what I paid for it when I bought shares of that stock in the past.

Am I worried? No.

It's the stock of a solid company.

In fact, I'm happy that the price has gone down, because now I can buy more of those stocks.

Why are there red/negative numbers?

That simply means the current prices of those stocks are lower than when I bought those stocks.

If I get the value of what I have in COL Financial, and compare it with how much we deposited in 2012 in COL, the return is 38.85 percent.

Or around 19.43 percent per year (simple average).

This means that if we invested P50,000 in the stock market in 2012, the value today would be P69,425.

If we deposited P50,000 in a savings account in a bank in 2012, the value today would be around P51,005.

So even with those two red numbers in the screenshot above, I'm still ahead of the bank (with the 38.85 percent).

Please note that this website is for informational purposes only. If you need financial advise, please consult your professional financial adviser. Thanks!

What about that nice green 11.06 percent? Should we sell that stock and convert it back to cash now?

Yes, we can do that. But I won't, because its price is not yet near the Target Selling Price. I will patiently wait for that.

Here's the Lesson: Do not be afraid of red numbers.

Remember, we're into long-term stock investing. Look to the future. 🙂

To Your Success!

Kind regards,

Manny M. Viloria

Recent Comments