Friends are asking how a woman who invested P3,000 each month in the stock market starting at the age of 30, ended up with P22 million at the age of 60. In this video, we show you the computations using a basic table in MS Excel, plus the shortcut Future Value formula, that quickly gives you the final amount you'll end up with, assuming you invest a fixed amount each month for a certain number of months, and assuming a certain rate of return from the stock market.

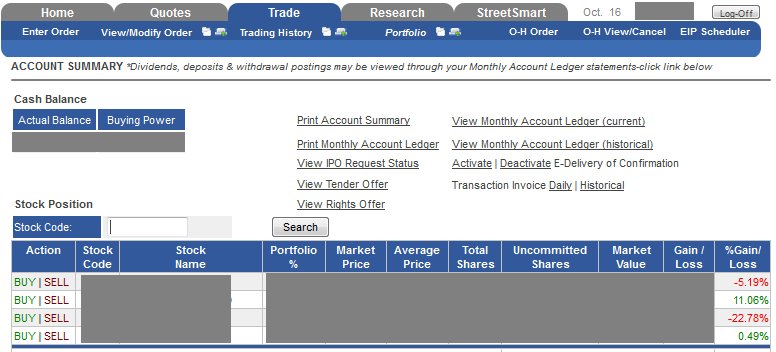

Please note, however, that you can make little or zero money from the stock market. Plus, there's also a risk that you'll lose money if the stock prices are low and you're forced by circumstances to sell your stocks at a price lower than that which you bought them.

While stock market prices go up and down regularly, some analysts believe that the overall long-term trend of stock prices of solid companies is upward. Some stock market mentors would aim for an average of 12% return on interest, while others would go for 15%.

Based on our experience, we've seen mutual funds (equity - stock market) grow as low as 3%, and yet others which grew at 18%.

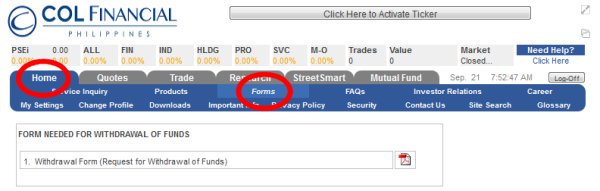

There's a step-by-step guide here for you who are interested in long-term stock market investing:

http://TrulyRichPinoy.com/tara/

The above guide helps you understand what you need to do before you invest in the stock market.

Kind regards,

Manny M. Viloria

Recent Comments