Looking at the Sept 15, 2019 Truly Rich table of stocks:

1 - I’ll buy the stock in Row 5, once the price reaches (Buy Below Price minus P11.40) or lower, and then will sell it when the price reaches (Target Selling Price minus P43).

This assumes a less than long-term investing approach, and is more aligned with my short-term experiment on locking in on profits within 120 days.

If that stock doesn’t reach the (Target Selling Price as of Sept 15 minus P43), then I’ll just patiently wait for the stock price to reach the Truly Rich Club’s recommended Target Selling Price.

2 - The stock in Row 6 looks like it will start moving up, so I’ll think about making a test-buy of that stock which it’s price is lower than the listed Buy Below Price.

Will the price move up or down? At this point, it looks to me like it can go either way, although there’s a slight indication that it will move upwards.

Hence, a possible test-buy for me on Monday, Sept 16.

3 - The stock in Row 7 also looks like it’ll be moving up, so I’ll do a test-buy while the price is still lower than the Buy Below Price.

4 - The stock in Row 11 looks like it’ll be edging upwards within the next few days.

5 - The stock in Row 12 also looks like it’s getting ready to move up. Let’s see if the price goes higher than (Buy Below Price minus P0.95)

If it does, I’ll consider doing a test-buy. Although am not sure if I’ll be able to actually buy stocks at a price not exceeding the Buy Below Price.

So most likely, I’ll wait for the price to go below (Buy Below Price minus P1.20)

IMPORTANT: Given my monthly budget for the stock market, I won’t buy more than 3 stocks per month. I’m making this stock market diary under the assumption: “What if I haven’t bought any stocks yet this month?”

In short, I don’t buy stocks every week, although I have a stock market diary entry more than once a month.

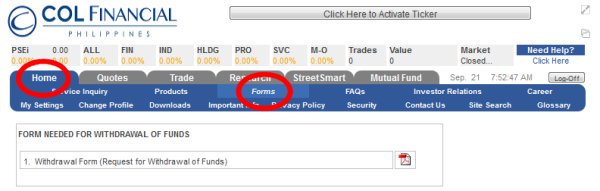

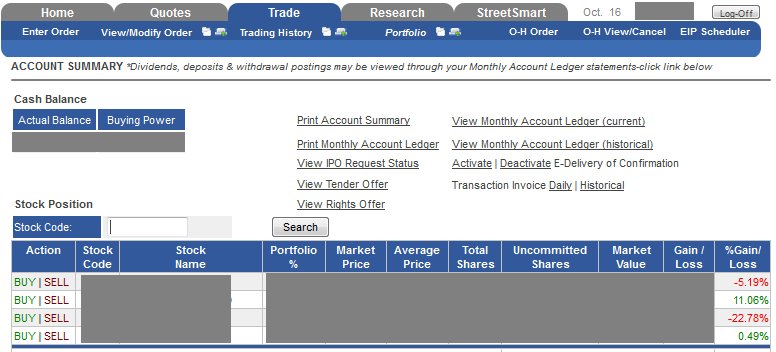

NOTE: Yes, I'll be placing GTC Buy Orders, and after those stocks are bought, I'll place GTC Sell Orders.

It's important to know your Entry and Exit points, so that you don't get too emotional about the stock price movements.

Join the Truly Rich Club at http://trulyrichclubjoin.com-review.org and access the Stocks Table in the paid members' area.

Get your step-by-step guide to how we invest in the stock market here: https://TrulyRichPinoy.com/tara/

Recent Comments