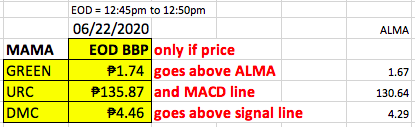

When you screened your stocks using the MAMA Stock Trading Strategy, and you looked for cases where the blue MACD line crosses over and above the red signal line, combined with the stock price going above the ALMA line, did you get results similar to the table below?

Remember that based on the MAMA trading strategy, stocks are purchased at EOD. Since the Philippine stock market closes at 1pm, the "EOD" referred to is the 12:45pm to 12:50pm time slot.

Are you a beginner interested in the stock market?

Check out the Step-By-Step Guide for Stock Market Newbies today.

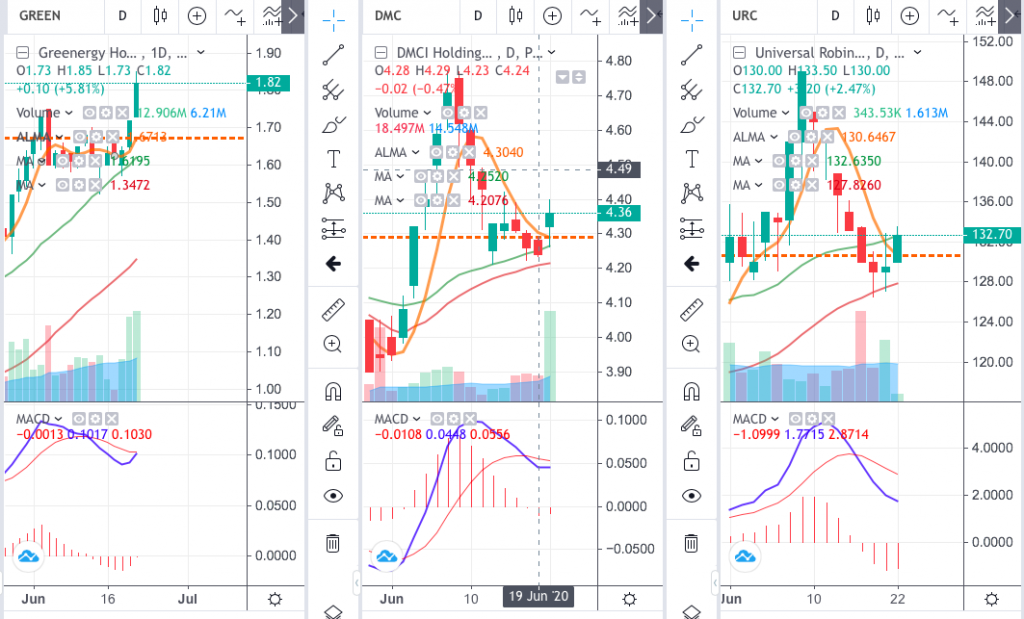

In the above charts, the MACD of $GREEN looks like it's about to cross the signal line from below. Such is not the case of $URC, so avoid being too excited and forcing a trade. Perhaps the MAMA strategy will be better on a future date for companies whose blue MACD line is way below the red signal line.

Recent Comments